Explore key takeaways from last week’s Cleantech Forum Europe’s panel on “Capital Strategies for Scaling Cleantech,” hosted by Sunly’s Innovation Lead, Rasmus Udde. The discussion covered unique capital requirements, early-stage capitalisation strategies beyond traditional venture backing, and useful musts for start-ups to secure funding. The main topic revolving around the goal that eventually cleantech start-ups will have to engineer and produce at scale in order to leave a dent in the climate footprint. Whether you sought cleantech financing opportunities or were navigating a capital-raising journey, this session provided invaluable insights.

Gary Urb, CEO of UP Catalyst, noted that the things you need to do, know and cover as a cleantech founder today are immense. When starting out, you never consider the financing, engineering or managing risk. You just need to start from the beginning and get these insights as you grow. In an essence, if you would know everything ahead of time, you would never even start.

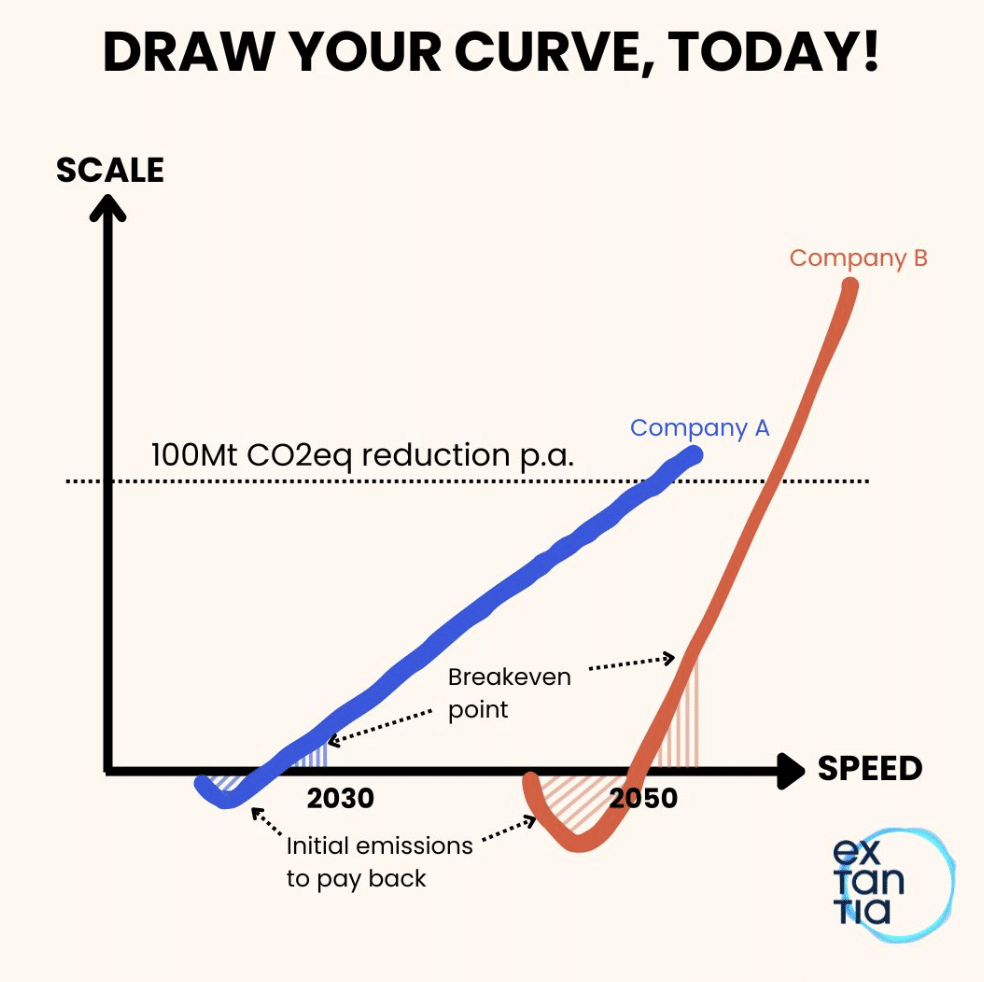

“The important thing to be mindful of is that companies are founded by scientists. But your first hiring should be marketing,” adds Yair Reem, partner at Extantia Capital. “It gives you exposure, and investors will know about you. When growing the company, growth is not linear, regardless of how engineers & scientists like to think linearly. Think out of the box, not linearly, because in reality, it doesn’t work that way. Things move parallel.”

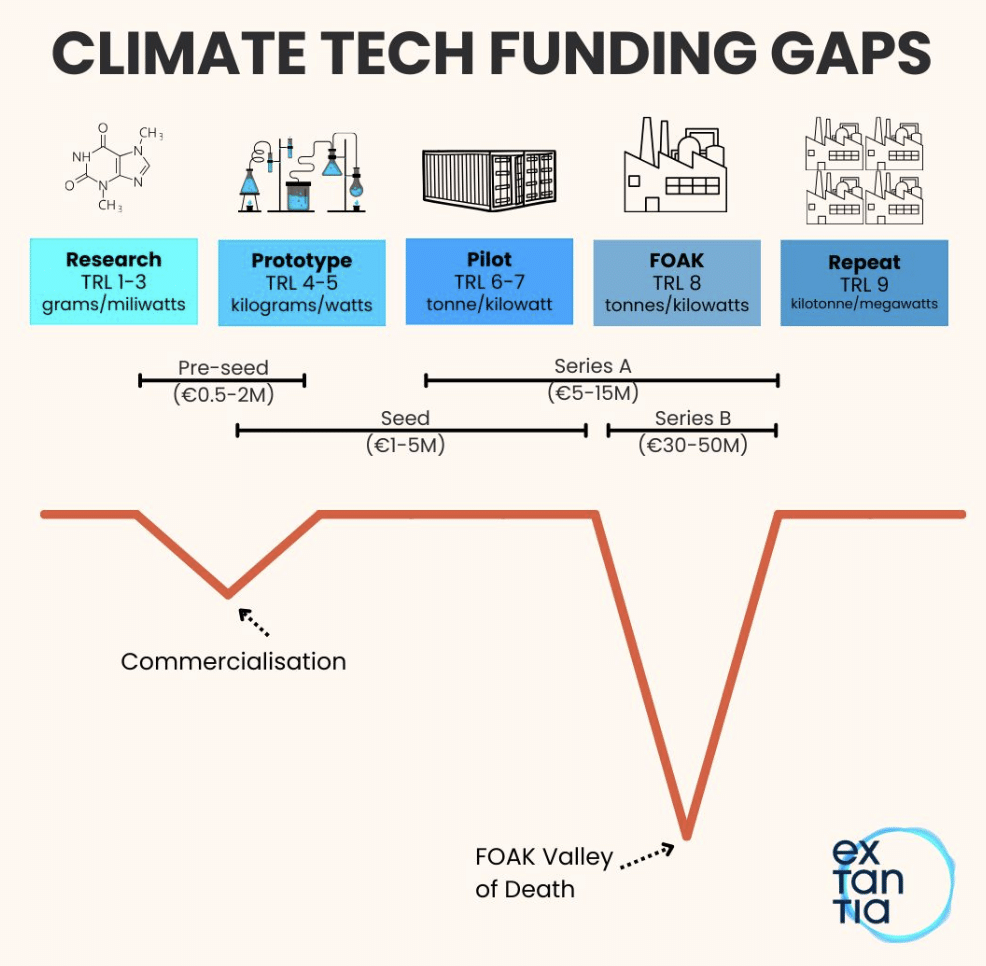

Mario Fernandez from Breakthrough Energy Catalyst adds that there are lots of project developers but not many that actually build things, and advises hiring product constructors. Cleantech in the end, when solving problems at scale, is an engineering problem. Everything that works on paper, needs to eventually be built. Founders vastly underestimate the engineering problem of growing production from 1g, to 1kg, to 1t or to 1kt. Each step is vastly more difficult than the previous one.

While lots of cleantech start-ups bank on selling licenses instead, Mario warns them off. “There’s too much focus on making a hockey stick module start-up. If Steve Jobs had started selling licenses instead of making the iPod, it would never have been what it is today. If you want to sell something new, you have to build it first, not just show the blueprint of it. Seeing it to believe it is not just a statement.” He goes on to insist that start-ups must build their first product. “Otherwise, the idea will wither and die.”

Two main thoughts were offered to Rasmus’ question about what makes cleantech bankable. “What helps, are strategic investors. Get someone who understands financing, strategic development, and balance sheets,” offered Martina Ecker, Managing Director for Cleantech, Citi. “Trusting that someone can actually construct your project,” adds Mario. “You have to lock it down at some point and give it to the constructing team.”

The whole panel agreed that scale is what’s required for ideas to work and get financed. “It’s not hundreds of millions, it’s billions needed. We need hundreds of factories turning a seed into solid material. Financing from banks is an absolute must. Find a way to get your company bankable. You have to explain and prove your product,” suggests Gary Urb. Mario Fernandez joins in admitting that as companies can raise money for only so long, a lot of seeds will die, but sees hope in EU. “While the US’ take on the regulations is the carrot method – I will give you something if you do this – the regulations – being the stick method – are here and can help move things along to get products out faster. This is what causes real change in the market. It helps that the Department of Energy here is made up of scientists and not bankers to get them across the valley of death”

“It’s hard work, takes much more time, and has quite a few more moving parts involved than expected,” adds Gary as an ending thought.